The Case for Farmland

In my last post, I stated that stagflation is a possible endpoint for the economic issues that COVID-19 will throw up. The reason being is low growth due to suppressed demand and catatonic supply, and a massively increased monetary supply. I ended it with two ideas: commodities and real-estate. Truthfully, though all real assets, including real estate, should do well in a stagflationary regime. Out of all the sectors within real estate what interests me the most if the asset class of farmland.

Lately, investors have been looking for alternatives to secure some form of returns in this 'unprecedented time' (AFR 1, AFR 2 & S&P GMI). After all, if you look at the graph below, over the last 6 months, the two farmland REITs on the ASX have smoother and better returns than the S&P All Ordinaries Index (XJO). In general, farmland is considered to have moderate returns (Global Ag Investing). The risk, however, depends on the asset itself, it's location, age and other attributes.

The two farmland REITS vs the S&P All Ords Index (Commsec, 6 month period smoothed to weekly returns. As of 10/05/2020)

Even looking on a ten-year time frame, RFF (a farmland REIT) has outperformed the XJO looking only at prices.

I have written about farmland before (last time in Dec 2018). Quoting myself quoting Luc Nijs

Farmland has 6 main drivers (1) global population growth, (2) changing dietary habits, (3) agricultural productivity (which is both an issue and an opportunity), (4) changing climate patterns, (5) the rise of biofuels production and consumption, and (6) the increasingly limited availability of farmland.

But more than that access to those drivers, the inflation protection and income may be welcome for investors. This article will go into each of these drivers, along with a quick primer on farmland as an asset class.

Quick Primer

It is important to note that no piece of farmland is alike. It differs by the physical location, climate and livestock/crop on the land. There are a number of companies that invest in farmland in a REIT structure.

In general, the strategy in farmland investing is to own productive agricultural land that can be leased to experienced counterparts/farmers. Income is either derived from the lease itself or as part of a profit share with those that use the land (Some landowners like Vitalharvest on the ASX do both). Modest capital growth is expected to occur over time as the agricultural property assets increase in value, driven by increasing competition for farmland.

Farmland can either be in greenfield or brownfield projects. Around the world, most arable land is owned by those that live and work on it. So for the investor, there is a large amount of land that can be bought up, and if in the same place scale can be achieved.

The value of agricultural land can be determined by demand, driven primarily by the profitability of the agricultural enterprise, and the supply of productive farmland on the other. As I will go into later, there are good reasons to be bullish on both supply and demand drivers.

The profitability of the enterprise is the profit gained from the crop/livestock less the inputs. And the inputs can be substantial, up to 50% of the expenses may be incurred just by planting seeds on a farm. This can be further complicated by commodity cycles that make it hard to forecast the future. Over the long term, supply constraints and the increase in mouths to feed mean that farm value should continue increasing.

There are numerous ways to get access to farmland. Directly owning farmland, through a REIT structure (listed and unlisted), or even through equity/debt exposure to agricultural companies that own land.

Important risks include general investment risks, climate change risk, agricultural/commodity risks, liquidity risks and tenure/counterparty risks.

On the ASX there are two REITs that invest in farmland, Rural Funds Group (RFF:ASX) and, Vitalharvest Freehold Trust (VTH:ASX)*.

Key Drivers

1) Global Population Growth

It's pretty obvious to talk about this driver. Population growth outside of the West is high, and in Africa, it is expected to keep on increasing albeit at a slower rate than during the '70s-'90s.

Looking at the UN Population Highlights booklet (2019) the medium trend forecast is 8.5bn mouths on our planet by 2030, today that we have 7.7bn people a 10% increase. Sub-Sahara Africa is expected to account for a large amount of this growth. With increasing age expectancy and an increase in living standards, those older than 65 will be expected to outnumber those younger than 65.

Different areas will have different population trajectories though.

According to the European Commission (link), more than 80% of growth in global demand for field crops, fibre and beverage crops, meat and forest products by 2030 will occur in the developing world.

More people means more food needed. Already according to the Food and Agriculture Organisation (2019) 820m people do not have enough to eat. And in Africa where the growth in population continues at high rates, this could lead to a disaster. This comes as food supply per person has increased (link).

Already we will need a massive increase in farming productivity to support everyone on this planet.

2) Changing Dietary Habits

Not only will there be more mouths to feed in the future in developing countries, but the people in those counties will also be richer. There is a rising global middle class and all up they are expected to hit more than 5bn people by 2030, with their spending expecting to almost double (link). According to the European Commission that will increase food demand by 35%.

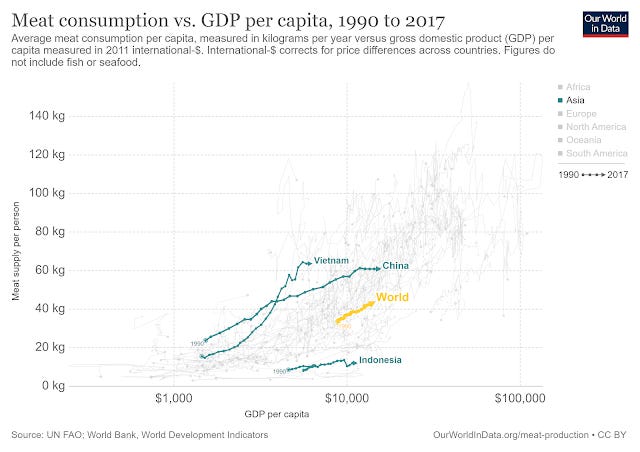

For example, meat consumption has risen in many countries where incomes have risen.

It's not just meat, certain cereals, wine, dairy products and other food have a positive demand correlation with income.

Further according to the Centre for Tropical Agriculture and Consultative Group for International Agricultural Research (2017) there are numerous other trends that are occurring that are bullish indicators for farmland, diets are getting more diverse and national diets are getting more similar.

3) Agricultural Productivity

To support the trends from the above two drivers, the productivity of farmland will need to increase. According to the National Intelligence Committee (2012):

The world is already farming its most productive land. Given the limited availability of new agricultural land, improving crop efficiency will become especially important to meeting global food needs.

The wildcard in meeting agricultural demand is technology. To meet the demand for meat and all other crops we will need to do more with less. Vertical farming digital/IoT based farming technology will also help alleviate these problems. To learn more about 'cool' farming technology here is a link to Precision Agriculture Magazine.

There are debates though about how far we can take farmland productivity in the short to medium term. Low hanging fruit and the law of diminishing returns means that it may be harder to get more crop yields with fewer inputs cheaply.

4) Changing Climate Patterns

The changing climate is of particular interest to the farmland investor. It represents one of the greatest risks of holding land. For example, How does abnormal rainfall affect the tenant/the land? The effects that a changing climate can have on farmland includes:

soil degradation,

water scarcity,

rising global temperatures,

abnormal climate-driven weather events.

Make no mistake, food security WILL be aggravated by changes in the climate. The risks from climate change can only be partially mitigated through climatic and crop/livestock diversification.

5) Biofuels

Biofuels are energy sources created by biological/living mass. An example of this is biodiesel that is created from animal tallow or soybeans.

According to the International Energy Agency (2019), transport biofuel production expanded 6% year-on-year in 2019, and 3% annual production growth is expected over the next five years. Of course, there is a caveat that fluctuating oil prices will make this either attractive or not.

A positive, even in the face of historically low oil prices at the time of writing this, is that internal combustion machines are still needed for maritime freight and aircraft. If the world wants to work together to combat climate change, biofuels will need to be in the mix for at least the medium term. Even in the slow maritime freight industry, we are seeing ships clean up to stop using dirty bunker fuel (link).

There is a very large gap in what is needed to help the world escape the risks from the world warming up by 2 degrees. Scaling up and commercializing biofuels will help green the world.

6) Scarcity

There are no shortage of articles and think pieces on the scarcity of arable land. And it's not just that arable land can be hard to find. Sometimes through use and through pollution, we see that land degraded and becomes unfit for use. Further issues that come with the changing climate patterns and the stress from extra meat consumption could compound the lack of farmland that is needed to feed everyone in the world.

Although with new technology like vertical farms, and the rise of vegetarianism (along with fake meat and dairy) there is hope that we can overcome the scarcity factor.

But in general, scarcity of productive land is why farmland is a long term store of value and why it should appreciate in value.

Why Farmland Now?

The COVID-19 economic crisis will continue to play out for years. Many trends that people have been discussing will be accelerated and new ones will start. What makes farmland a good asset to hold in all periods is its lack of (or negative) correlation with other major asset classes apart from a modest positive one with commercial real estate (Nijs 2014).

Hancock Agriculture Group (2013) found that no matter the level of inflation, that farmland has outperformed inflation (high, medium or low levels of inflation). According to Nijs (2014), the real return over the long term is around 2% and returns are negatively correlated with CPI.

At a time when yields are low, uncertainty is high, at least we can be sure people will want to eat. Now is the time to be looking at alternative ideas like farmland.

RFF is one of the only REITs on the ASX to confirm its guidance and with a dividend yield of 4%, it looks attractive.

*Disclaimer: I own units in both REITs