Select Harvest Water Cost Risks

Select Harvest Water Cost Risks

Limitations

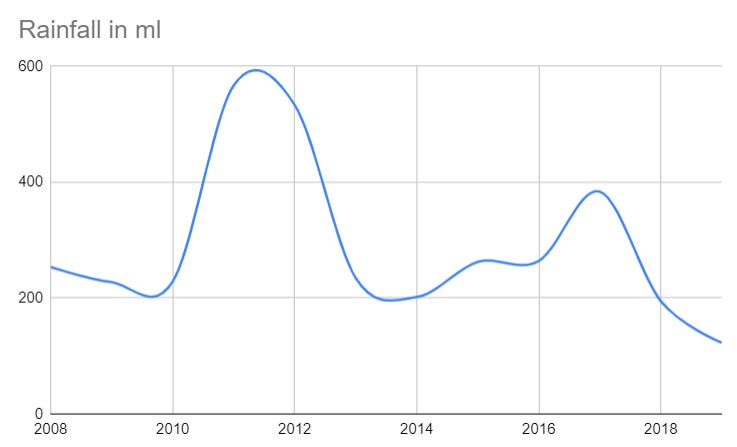

One notable limitation of my research was the accounting and reporting practices used by

Select Harvest. As you can see from the chart below, when simply multiplying the number

of almonds sold by the almond price, it did not always sync up to the reported revenue value

for the Almond division. As a result, some of the unit economics of this company is difficult to

confirm with certainty.

Identifying Water Usage

SHV has reported its water policy, which is acquired from the following sources:

⅓ Permanent water entitlement

⅓ Water leases (long-term leases from irrigators)

⅓ Water Spot market

In the Select Harvests 2017 Sustainability report, it was disclosed that the company

used 77,800 ML of water. This equates to 10.8 ML per hectare and 34.24 ML per acre for 2017.

Assuming the amount of water used per acre is the same over time, SHV will require roughly

79GL for 2019’s harvest (10.1 Per Hectare * 7,696.00 Hectares).

Which directly impacts the amount Select Harvests needs to buy on the market.

As a result, taking into account this year’s rainfall of 123 ml, and negate that from the water

usage needed for this year, the leftover ML needed from the market is 68,534 ML.

Water & CoGS

As rainfall increases, the need for water from the market decreases and thus the cost of goods

for the company also decreases. Below is a test of this hypothesis.

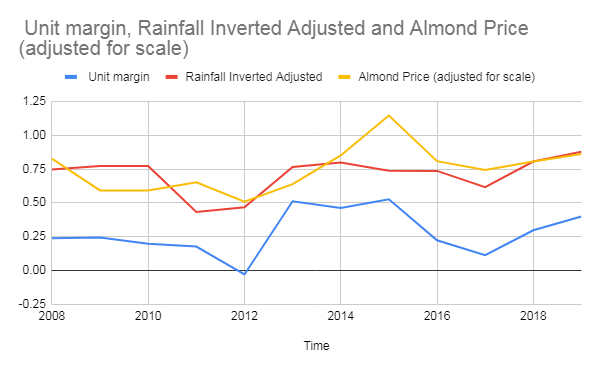

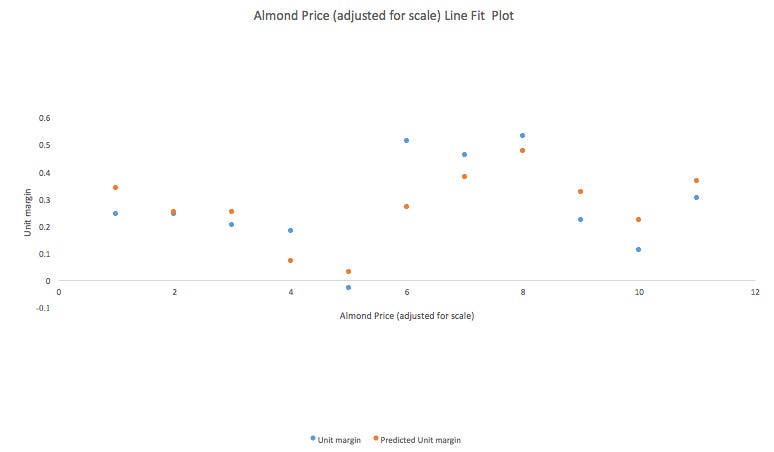

Rainfall and almond prices have a meaningful impact on the company's margins. Water prices

and almond prices impacted 60% of the movements of the almond division’s margins. This data

point reinforces the trend of water prices and rainfall impacting previous margins, to then make

the extension of using said logic in future years is as a reasonable assumption.

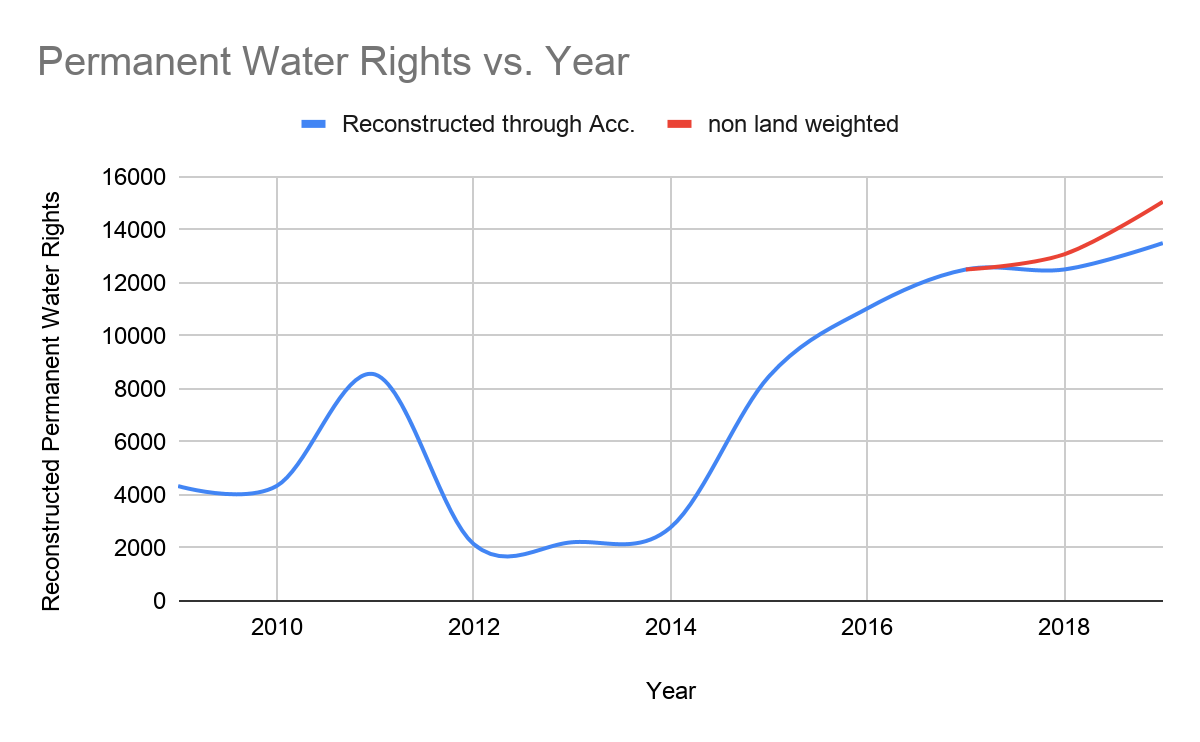

Permanent Water Rights

Using the sustainability report which was only released in 2017, it was discovered that they

used 77 GL of water. Taking into account their water policy, this leads to approximately 22 GL

of permanent water allocations.

Using information from the 2018 & 2019 Annual Reports, their permanent water allocation can

also, be calculated as follows:

Year

Valuation at

Current Market ($ m)

Historical ($ m)

Simple Calculated

Perm. Water (ML)

Land Weighted

Perm. Water (ML)

2019

85.8

37.9

13071.19

13870.71

2018

51.6

31.7

15052.63

13191.65

Sources: SHV Annual Report 2018, Page 61 ,

SHV Annual Report 2019, Page 62

The ‘Simple Calculated Perm. Water’ represents the amount of water they would hold, using an

average of the water costs across regions, while the ‘Land Weighted Perm. Water (ML)’ calculates the water

required for each region, weighted by the percentage of farms within that water trading zone

(shown below).

Percentage of Farms per Water Trading Region

NSW Murray below Barmah Choke

25.57%

Vic Murray from Barmah Choke to SA Border

28.33%

South Australian Murray*

20.72%

Murrumbidgee

25.38%

Source: https://selectharvests.com.au/geographic-diversity/

To figure out their water holdings, information from the annual reports from the years 2009 to 2019

were used to recreate the permanent water allocation. This was done by using 2009 permanent

allocation prices to create an initial estimate of the current allocation held, and then each subsequent

year calculating the amount of water bought, weighted to each water trading region using the above

proportions.

Reverse engineering water cost

In the full year 2019 presentation, SHV reported spending an extra 3 million on water costs,

a 54% increase on last years cost. costs roughly $9.5 million.

In the earnings call for that period, it was stated that water costs were roughly 11% of CoGS.

This would readjust the cost to $12.32 million. Select Harvests has had to use roughly 77,992.55 ML

of water in 2019, had 123ML of rain, this means they had to get 68,400ML from the market

(leased, spot and permanent). Minus 21,000 ML (very conservative estimates) from water costs

expensed via investing cash flows over the years. It is important to note that since Select Harvests

bought a lot of permanent and they spent between $9.5 million, and $12.3 million, the dollar cost

average per ML was $200 and $261 respectively. Obviously, this is the cost of not evenly spread

amongst the two streams, leased and spot prices, but to have an average between $200-250

it means a significantly lower spot price than the current on the market. In the event of half of the

water cost $800 and the other half costing $200, the dollar cost average would be $500, an

increase greater than 100%. As a result, this would increase water costs to $19 million, and $24

million respectively based on the reporting.

History

Select Harvests has faced a similar water season before, 2008. During this time the stock tanked,

however, this leaves the question: Is this time different?

If we examine permanent licenses, rainfall, and spot prices, we can see where 2019 is in relation

to 2008.

In 2009 the cost of water per acre was revealed in the annual report. We can use this as a benchmark

for what could be in the next quarter’s results. In 2008, Select encountered massive spot water costs,

which severely impacted the stock price. Average spot cost per ML was $900 and it cost Select

Harvests $1,680 per acre. Additionally, in 2009 spot cost was $690 per acre and a spot price of $300.

By contrast in 2019, the average spot cost by the end of 2019 was $800 but only spent ~$800

per acre, which implies they only spent ~$225 on spot.

By contrast, Select Harvests had almost no permanent entitlements compared to their total

acreage in 2008 and as a result, Select Harvests has a 25% free buffer (from an accounting

point of view due to the investing cash flows) from water costs via their permanent allocations.

Conclusion

Hopefully, this article has been a good primer into the some of the lesser pronounced risks with

Agricultural stocks, in particular Select Harvest. As water prices have come down in the last month,

water price risk is far less parlous than earlier this year.