Passive

I have been getting a few requests in my personal life about younger people wanting to invest but not knowing where to start, or what to do. So I thought I would write a quick post on what I think should be done with the caveat that I am not a financial planner and you really should see one.

No, please, go see one.

But I digress.

We will quickly go through the basics, and then lastly to how I think most people's investment portfolio should look if they are younger than 40.

Basics

Let us start with the basics, as with most things in life, this is risky. And for some people, this money may be all they have or they cannot afford to lose this money. If this is the case rethink investing and/or trading. For example, my coworker who once worked in research at a big investment bank thinks all investing is gambling.

I disagree, but some forms do feel like it (I'm thinking of you microcap technical analysts).

So, if you're going to invest a good rule of thumb is: do not invest any money you think you will need in the next 10 years. That means you, you who are reading this and want a house deposit in 4 years.

Why?

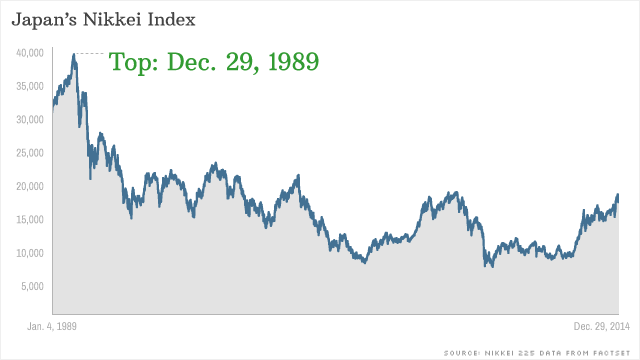

Above, this is Japan's equities market from 1989 to 2014. And it still has not recovered from its top in 1989. That market top was before I was alive.

That is what can happen.

And this could happen here in Australia, or the US or wherever. And this could be bad for your next avocado toast or whatever Boomers are complaining about that us Gen Z or (worse) Millenials are spending on.

But the good news is you can probably expect a (conservative) 4-5% return on average per year. That is on average, so some years may be much better, some may be much worse.

I do personally think that investing and trading are not the same and the main difference is that trading has a time frame of less than a year. Whereas investing is a life long pursuit that has a timeframe of 5+ years.

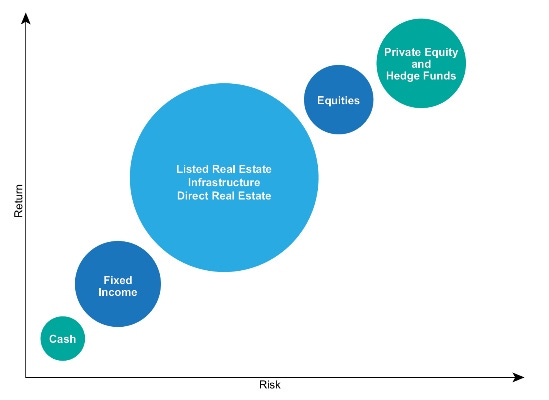

Now, most people think of equities (shares) when they think of investing, although this is one of the more risky forms of investing. Another asset class is fixed income but most people do not have the means to buy it outside of an ETF, let alone know what duration is and how it relates to portfolio construction. And usually, most people will own a majority of their wealth in a property (where you live) so getting more of that for most people is over concentrating their wealth in one asset class. Below is a bunch of asset classes and their risk vs return.

All asset classes have different risk and return profiles, within the asset classes are securities or individual picks which again, have their own risk and return profile. Each security also gets their returns differently. Either through distributions/dividends (giving out money to someone who owns a unit in a trust or a business) or through capital gains or a mixture of the two.

Investing means finding an optimal asset class mix, and inside the asset class finding optimal security selections. This can take ages to do. And further, no-one knows what optimal is. Financial advisors and university professors and Jill down the road, all do not know what is the best mix of assets and securities are. Is Tesla stock a buy? What about GE bonds (which ones too)? What about an investment property?

There are a few questions that can be asked though. How much risk can you handle? How much can you invest? What do you already own? What is the timeframe of the investment? Etc.

The answers differ for everyone, which is why investing and trading, which are the sexy parts of financial advice are always talked about. Studies show that even more important than that is your savings rate, and not overspending and all that (more on that here).

Assuming you understand these basics we can go to the next stage.

Edge & Return

Now to be a great investor you need to create something called alpha. That is outsized returns that are not explained by market returns. Edge can only be created in one of three ways.

1. Information edge,

2. Analysis of said information, and,

3. Being the quickest at acting on the analysis.

Edge usually works because you're getting or doing something that others are not, thus you may find or do something that others in the markets are not, and thus get alpha. Of course, though you could get negative alpha, be worse than the market.

(In some case you may be doing what everyone is doing and getting alpha, that could be trend following or leveraging beta, but the weeds in all this information are thick and we should not dwell on them.)

There is also something called beta, which tracks the overall market. Beta investing or tracking the index is what most investors should do. It's cheap to do, takes little time and you cannot underperform the market. Usually, to be clear, we talk about tracking the market meaning tracking the stock market, whether that be the ASX200 or S&P500 or some other variant of a stock index. But it can also be done with other asset classes. And also inside of asset classes, i.e. follow a sector such as healthcare or AAA-rated bonds.

It goes further than this. You can now get so-called "smart-beta" products which track factors. Factors in this case meaning tracking quantifiable characteristics such as cheapness or momentum.

Now everyone who reads this probably won't be able to compete with the many thousands of companies and people in the investment industry getting alpha. To get an edge through #3 as you need data centres close to the exchanges and quick computers etc this can be expensive and requires great know-how.

But number #1 and #2 though is alive for the individual. You just need practice for #2 and to find a sector or section of securities that not many people are looking at for #1, otherwise known as a niche.

But even an informational edge is hard to get. Peter Lynch once said that finding general information like lights on at a factory at night, when they were not previously, could give an edge. But I would argue, for most, the effort in finding alpha/excess returns is too much. It's easier to be passive.

It is easier to buy cheap beta and own an index than buy individual securities. Note in a simplified manner that in passive investing that you do own individual securities you just don't pick who they are, how they are added etc.

Defensive vs Aggressive

Depending on the risk (and therefore return) ceratin asset classes are known as either defensive or aggressive. Defensive assets have a lower return but keep intact your capital better, usually, this means it's either cash or fixed income.

Aggressive is usually taken to mean hedge fund products, equities or derivatives. Some assets are hybrids of the two like property and infrastructure which show elements of both. Or even a mix between shares and fixed income such as a convertible note.

Portfolios should be made of both in such a way to limit downside risk (the risk of losing capital) and to increase your returns. Even within asset classes, security picks may be more defensive and show different characteristics than others, for example in Australian healthcare stocks there are big safe plays like CSL Ltd (CSL:ASX) and much more unsafe small R&D plays Exopharm Ltd (EX1:ASX).

Further studies show that the asset classes you invest in make up a large amount of explainable variance in your portfolio (here).

What I am trying to say is investing and trading is extremely complex. Which is why I tell most people to be passive.

80% VDHG & 20% VBLD/VAP

That's why I recommend a portfolio built of the above.

VDHG gives one access to a well-diversified (if aggressive) portfolio. The yield is much less than holding Australian blue caps but it is worth the diversification, which decreases risk.

This is what VDHG holds, on behalf of you:

Overtime for the budding investor, holding VDHG should be a great play, and it will do the rebalancing and take all the complexity out of investing for you. If you put the dividend given from this ETF back into buying more, you will compound your money incredibly well. This is diversified both geographically and by asset class. with a small number of defensive assets and a lot of aggressive ones. Perfect for most young adults.

I like to tell people to balance VDHG with VBLD or VAP (or even both, 10% each), they have a higher yield and you're holding a real asset, so hopefully, it holds up in down periods. VAP/VBLD also should be an inflation hedge as you're holding something tangible, something that should have residual value or a floor to the price you would want to own the asset.

VAP is a property fund, it holds a bit of every Australian public real-estate trust, it will further concentrate your holdings into property, but not a house, multiple houses, plus offices, factories, farmland and the like. VBLD holds infrastructure securities listed in developed countries. It offers investors diversified exposure to infrastructure sectors, including transportation, energy and telecommunications. VAP/VBLD is just there for extra safety and yield.

Overtime I would make sure that it tracks the 80/20 and only bother rebalancing to the right amount when it's above a 10% difference, say 69/31.

That is how I would build my passive portfolio so I could get back to socialising and reading books. And not worry nor spend too much time thinking of the markets.

Addendum

I wrote the majority of this before the Covid-19 panic at the end of Feb 2020. With a portfolio made up of the above, you would hold in any market downturn and not sell. The above 80/20 portfolio is an ultra longterm portfolio made for 20-year-olds up until they are 45 or even maybe 60. Short term macroeconomic issues should not be a problem with this portfolio and one should not worry about how much money, on paper, you have lost.

Of course, if you have more money than you can handle losing in the market, that is a different issue. As I said above, do not invest money you need in the next 10 years. Always have a buffer of six months cash in the bank.

Disclosure: I personally hold Exopharm Ltd.