Narrative, Rates & Inflation

Everyone knows that everyone knows x

— Common knowledge under Game Theory.

Investing is, in general, an edge game. How do I create alpha? What makes an edge game such as investing interesting is alpha itself is the edge. As defined by alpha being the creation of outsized returns. That leads to an interesting tautology, that for everyone to beat the market they have to be doing something different from the market or being a contrarian. Can you really be a contrarian?

Well, yes, you can. Livewire just ran a story about a fund manager talking about the future of retail. No one likes retail at the moment, do they? But what makes contrarianism hard is that most are being contrarian, most professionals stake there careers to be contrarian, else why chase alpha when you can go passive? There are only so many contrarian ideas to go around.

That leads to crowding and importance for narrative. It's important to understand the memes that create the sentiment that changes investors allocations.

That's why I wrote this note. One narrative has dominated financial news and social media, contrarians cannot miss it, and it turns us all into sheep.

Everyone knows that everyone knows that central banks are going to cut rates.

As soon as markets started moving down from late Feb due to Covid-19 fears, it was only a matter of time before Lowe and Powell cut rates. Why? It has become standard practice for any weakness in the real economy and financial markets for a cut in interest rates.

From an economic prism, most people know that the Covid-19 crisis is a supply-side issue. Demand is deferred, but supply is crunched. As my co-founder of Billson Porter Jay stated to me "due to Covid-19 people may put off buying an iPhone, but they still will buy one in the future. But a factory cannot respond to the built-up demand by going at 200% capacity".

Regardless of the logic the RBA and the Fed have cut rated by 25bps and 50bps respectively.

This was predictable and predicted. The AFR's Market Live blog even posted a list of who was backing a cut from the RBA and who was not. It was 50/50 on a cut or not, but they quoted the CBA's economist Belinda Allen as saying "A fiscal response would be more appropriate." The problem is, it was not what is appropriate, it is what the narrative demands. Citi's analyst had it correct with the quote being "... the path of least regret." Which is was.

Since the GFC financial markets are propped up by the central banks. And they will continue to be so.

On the morning of the cut, yesterday, stocks were up on the ASX, people knew that a cut was coming. Hence discount rates got trimmed and stocks became more valuable. An investor I know had a conversation with me and Jay to discuss the continuum of rates and how a cut to actually stimulate the economy would be a magnitude higher, as it would penalise saving and force investment (assuming it does not occur at a recursive rate).

That's the problem, he hit the nail on the head. We all know this is a farce, that a cut won't help, won't cure the economy from the Covid-19 virus. But a cut is expected as it is the current playbook. In gaming terms, it's the meta. Stocks rise due to the narrative being true.

The narrative is that central bankers will step in. And they do. I'll hazard a guess on most trading floors they all knew it was coming and positioned accordingly.

The problem with negative rates though is that it pushes insurance companies, pension plans and other ultra-long investors into risky assets and doesn’t necessarily create jobs or push up CPI inflation. It will increase asset price inflation though.

The playbook from knowing this is that equities rise. As they did. The narrative is a cut is good for risky assets.

A rate cut may stabilise markets (see Philip Lowes' speech here) but does that not push away from today the issues and make them tomorrows issues? At what point are we pushing on a string? The number of so-called zombie firms continues to increase (here). PIMCO speculates that current demographics keep rates low (here and here), what does that mean for negative 500bps? How does a 70 year old’s super look? Can they hold negative-yielding fixed-income as a defensive asset?

Without the economic worries from Covid-19, asset prices will rise. It is the extension of low rates logic.

Looking at the US

More than that, what should be known is that inflation will rise. This comes from record world-wide low rates. If Covid-19 goes away, then rates would presume that inflation increases, If Covid-19 stays with us as a problem for the next few months, the supply crunch will raise inflation.

Further, if there is a credit crunch and debt cannot or will not be issued zombie firms will go under, decreasing supply of goods and services. This could happen under a bad Covid-19 future.

Regardless, this all ends with inflation higher.

I think that is the new narrative. Inflation.

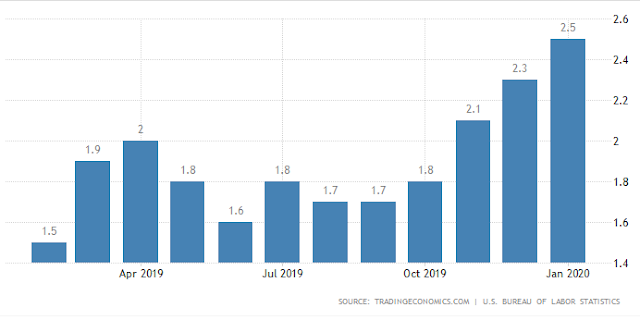

Look at the chart below of inflation in the US. It is already above 2%.

Quoting my co-author Jay:

An interesting opportunity to me in this space are TIPS for the US & AUS in light of COVID-19.

Implied inflation by treasury yields + TIPS indicates inflation below 2% due to a demand shock. I find this to be quite an aggressive way to price the probability of future events given inflation is at ~2.5% currently.

I believe supply, however, has been stopped, and not postponed. This is because in China, manufacturing capacity is generally near 100%, and factories cannot simply run at 200% next month to compensate for lost production.

Although speculative, I think that this is a very cheap bet on an event which is a lot more possible than markets think.

Perhaps that's the edge we can get using the current narrative structure in the market.

Everyone knows rates are low. Everyone knows there are inflationary pressures. How do we play it for edge? As Jay says, TIPS.

WJD