Closing the Brazil trade

Closing the Brazil trade

Closing the Brazil trade link to the reference article is here

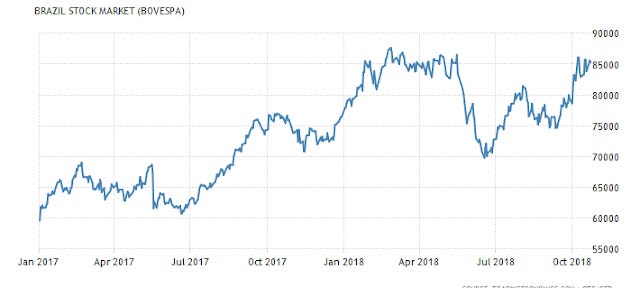

As markets all around the world sell-off Brazil's two largest security markets: government bonds and stocks, they continue to rise. It has been interesting to observe the culmination of pessimistic predictions, volatile currencies, and ‘better-than-expected’ results, delivering a whip-saw impact on these markets. The downward spiral we saw at the beginning of the year within these markets was unsustainable, as there was no sign of the fundamentals reinforcing the sentiment. The result? An interesting asymmetric risk opportunity for only the bold to take.

The Brazilian stock and bond market is up 21% and 12% respectively from Billson Porter's blog post about it.

I think it is important to understand that there were lots of factors that I didn't explicitly (the details of the politics) account for in my thesis so nieve luck was definitely part of the magic in this trade.

Going further, I have no more opinions of where I think these markets will go as I'm sure there are far too many dimensions to these two markets for me to understand out of a reflexive situation.

Thank you for reading,

Jay