Closing the AUD trade and additional comments on the Thai Baht

Closing the AUD Trade:

From when I first made the bearish call on the AUD at 80 cents, the currency has depreciated 6.8% to ~74 cents. This can be attributable to the reasons in which I previously stated, and that the most likely lever that was propping up the AUD, iron ore, was to give in. As a result, the AUD has depreciated at a disproportionate amount relative to iron ore, which I believe was caused by reflexivity.

The current value of the AUD could be easily considered fair value or slightly undervalued with a good rate at 75 cents, based on previously mentioned factors.

Original post here

Additional Comments on the Thai Baht:

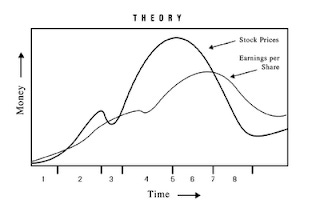

To demonstrate additional reflexivity with the Thai Baht, I've shown a graph of the Thai Baht to the Singapore Dollar. The reason why I think this chart is meaningful is that the Singapore Dollar represents an almost relative comparison against the US dollar as another Asian currency. With this in mind, you can see compared to the Singapore dollar, the Thai Baht has been outperforming. What is most supportive about this chart, however, is the very similar characteristics it bares with Soros' original chart of reflexivity, with excess Thai imports over Singapore being the earning per share in this case.

Original post here

Jay