Breaking down the most important metric of Dropbox

Recently in a job application, I was asked what was the most important metric of business quality for Dropbox. At first, I found this question confronting. I was being asked to try and sum up a whole business's quality through one number.

To tackle this I did what all prospective investors should do, and read through the S-1 prospectus. What I found is that despite from what on the outside seemed to be a massive target to be 'googled' by Google Drive turns out to be an extremely, what Warren Buffet calls, 'sticky' product.

What makes a quality company?

What is important to clarify in this writing is what actually makes a company valuable in both quantitative and qualitative terms. Quantitatively, a companies value is simply the net present value of its future cash flows, or in laymen, the amount of cash a company can generate for over the course of its life discounted by the value of time (a dollar tomorrow is worth less than a dollar today).

Whereas if you want to represent this qualitatively, a great company provides an excellent product with an incredible competitive advantage that means its users will be tolerant of price increases.

Dropbox rundown

Before I delve deeper into the company I will give you a quick summary of what Dropbox does, who are their competitors and how they're monetising their platform:

Dropbox is a cloud storage company for both enterprise and individual use

They monetise by giving the user expansions of data control and storage sizes for a monthly fee

The company has roughly 500 million registered users, which has been growing at a very strong rate of ~30% YoY.

As of 2017, it has 11 Million paying users

Average Revenue Per Paying User at $110

It also has $USD1.1 billion in revenue from those users

The main competitors are Google, with their product google drive, and Microsoft with One Drive

Highly sticky, poorly saturated

After reading such impressive figures from their paying customers, I got skeptical, my first thought was that surely customers get burnt out and don't have good LTV (Lifetime Value).

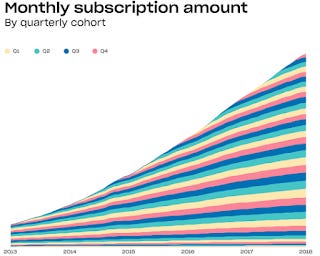

I was proven wrong though as I progressed through the prospectus and found a graph showing the number of users that had signed up from each quarter of each year and the amount of money they each paid throughout time. The second graph shows how much more the average user will spend on subscription after they start paying for the service. The graph displayed that not only do subscribers continue to pay for Dropbox subscriptions every year but also that they increase the amount they spend on the product every year. This is incredible.

A great comparison of such a sticky product would probably be the iPhone as not only do users who own iPhones stay loyal to the brand, they are complicit to rising prices and buying apple accessories along with it.

The drawback of these excellent metrics is that these profitable figures represent only ~2% of total registered accounts, bringing the ARPU down to a much smaller figure.

Having a deeper look at the cost of paying customer acquisition if we divide the amount spent on marketing by the number of new customers, unsurprisingly it's becoming more expensive to gain clients. Last year the average cost of acquisition for a paying user was $142, up 31% from last which was $108. This is expensive, and it does become more troubling that the marginal impact of acquiring new paying customers is diminishing.

Calculating the lifetime value of a Dropbox subscriber

A look into the lifetime value of a Dropbox subscriber will show the sheer quality of their cash flows, as customer retention averages at 90%, and 100% for their enterprise users. Additionally, Dropbox is able to produce a lot of annual cash flows per average user, with a previously mentioned ARPU of $110 and an adjusted cash flow (net cost of goods and admin) of $52. If we also factor in that the new users (2.2 million/11 million) from 2017 will pay double their initial subscription in 12 months time we can say very conservatively, that the discount rate on these cash flows will be very low (2%) if we don't factor in the growth of the new users. After all these considerations, I calculated an LTV of $390. What's very appealing about this is that as a return of the COCA, the added value is 174% for Dropbox.

Threats to Dropbox's longevity

Competitively, Dropbox has a big looming threat, Google. Their service, Drive has close to a billion users, almost double that of Dropbox. This is a large issue for Dropbox as Google has the main advantage of having much stronger infrastructure than Dropbox. Google has both the ability to convert existing Gmail users into google drive users and is in the financial situation to burn cash a lot harder than Dropbox. Where, however, Dropbox can strive is its quality of service, in which it seems to have at this time with its remarkably high retention rate.

Conclusion

For these reasons, I believe that LTV is the best metric to convey the business quality of Dropbox. This number is able to show the stickiness of Dropbox's subscription service and thus demonstrates an unquestionable quality that keeps users coming back year after year. Changes to this metric will show if the company is able to continue to have a moreish impact on users or their influence gets deteriorated by competitors such as Google.