Brazil: Reflexive Opportunity

Brazil Trade:

The impact of bad corruption findings and other political tensions in Brazil has led to an enormous sell-off in all its major asset classes: Currency, Equities, and Fixed Income. The already bearish sentiment of emerging market investors as a result of US monetary tightening has meant that this negative catalyst has had the wind behind its back. These circumstances, however, led by speculative capital leaving the country due to increase credit risk and pessimistic views on Brazilian growth could open up an investment opportunity with an asymmetric risk profile.

What I mean by asymmetric risk profile is the propensity, and intensity of a potential loss are vastly dwarfed up its upside. I believe that the self-impacting mechanics of currencies will allow Brazilian equities and fixed income to both have a reflexive movement upwards.

Fundamentals: Commercial Trade and Financial Health of the economy

To take a look at how we can profit from emerging markets, we need to first look at the current state of Brazil. The country’s main export is soybeans, accounting for ~13%, then sugar and iron ore which both attribute to ~7% each. This means that these commodity prices impact the destiny of both the country’s income and currency demand. What is interesting about these commodities specifically are their counter-trend movements downwards. This is strange as the increase in inflation in developed markets (mainly Europe and the US) has generated huge returns for those holding broad commodity indexes. Although this may seem naive, I think we can assume that this general trend will give Brazil’s export commodities a margin of safety. This is namely because later in the article I will describe the hedge’s from general emerging markets to ensure specific exposure to reflexivity in Brazil.

As a result of lower commodity prices, Brazil’s Terms of trade is down, but the balance of trade is up and in surplus. Meaning inflation is low, which it is at ~2.4%, and higher quantities of exports are demanded. The secondary conclusion of this is that Brazilian productivity has gone up, which is great for long-term growth without the need of credit.

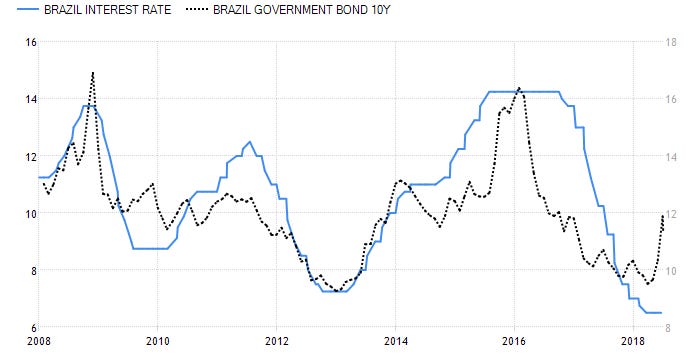

Some quick stats on the on the state of Brazil: Interest rates are at 6.5%, unemployment is high (12%), inflation is low (2.4%) and fiscal policy is having a diminishing impact on the economy. Debt is maxing too at US$1.2 Trillion, 75% of GDP. Growth is at a modest 0.4%.

Brazil Capital Flows: UIP and Coupon payments

Uncovered Interest Parity (UIP) dictates that a currency should depreciate/appreciate the interest rate differential of an FX pair. As a result, this means that the BRL has an expected return of -4% against the USD.

Secondly, as Brazil is fairly highly levered, it has to outlay lots of capital to foreign investors who have financed Brazil’s fiscal policy. To do this the Brazilian Real has to be sold for other currencies, increasing the neutral flow of overall capital out of the country. To illustrate the magnitude of these capital flows, calculating a ~7% coupon on Brazil’s debt (yielding 12%), the coupon payments have an outflow of ~US$72 billion. In comparison to its balance of trade surplus of just US$59 billion.

Speculative Capital’s power in an emerging market:

Where this trade becomes interesting, where the absolute power of speculative capital to shift the currency markets over fundamentals. We’ve already seen that just coupon payments on Brazilian debt being outlaid are larger than the inflows from trade. Additionally, this also happens when investors start unwinding their positions from both Equity and Bond markets. As you can see from the charts below, The BRL is far more swayed by these speculative capital movements than commercial capital movements. This is interesting because speculative capital is simply an abstraction of what investors expect commercial capital to be in the future. As a result of this, an interesting opportunity arises as these movements change the fundamentals they are trying to track via the exchange rate system.

The potential for reflexivity:

Equity risk premiums are also very high, with the stock market has sold off more than 20%, with a PE ratio of roughly 12.

The sovereign risk premium that investors have assigned for Brazilian debt has widened drastically as a response to this sell-off. I believe this is an efficient pricing of the risk truly present with Brazilian debt. This is because of two main reasons: the current risk premium for bonds is low (using the US flat yield curve as a proxy), and also because of the monetary loosening theme that Brazil has. A similar movement seemed to happen in both 2008 and 2015-16. The result of this is something that seems very reflexive, that has already begun to revert. I think reflexivity is also very likely as the BRL has gone down, making both Equities and Fixed income much cheaper for foreign investors to buy.

How to Trade:

I think that the best way to trade this is probably with options or leveraged products and tight stop losses. Taking long positions on both Brazilian bonds and Stocks but hedging out with a short position will also be needed on an Emerging markets index to hedge out any losses from macro trends.